We’ve all experienced it – walking into a store with a clear intention only to succumb to the allure of spontaneous buying. Impulse purchases can wreak havoc on our budgets and leave us with items we never intended to buy. But fret not, there are strategies you can employ to steer clear of these spontaneous splurges.

Understanding Impulse Purchases

Before delving into strategies, it’s crucial to grasp the concept of impulse purchases and the reasons behind them. Impulse buying refers to the act of making unplanned purchases, often driven by emotions rather than rational decision-making. Retailers adeptly leverage this tendency by strategically placing enticing items near checkout counters or offering limited-time deals.

The Psychology Behind Spontaneous Buying

Impulse buying is heavily influenced by various psychological factors, including:

Emotional Triggers

Emotions such as excitement, stress, or boredom can prompt impulsive spending. Many individuals turn to retail therapy as a means of alleviating negative emotions or seeking temporary gratification.

Fear of Missing Out (FOMO)

The fear of missing out on a good deal or exclusive offer can trigger impulsive buying behaviour. Limited-time discounts or scarcity tactics can instil this fear, compelling individuals to make rash purchasing decisions.

Social Influence

Peer pressure and social media play a significant role in driving impulse purchases. Witnessing friends or influencers flaunting new purchases may create a desire to keep up with trends or maintain a certain image.

Strategies to Dodge Impulse Purchases

Now that we comprehend the psychology behind impulse buying, let’s explore practical strategies to evade this behaviour and regain control over our spending habits.

Craft a Budget and Adhere to It

Establishing a budget before embarking on a shopping spree can serve as a potent deterrent against impulse purchases. Determine the amount you can afford to spend on non-essential items and allocate specific sums for different categories, such as clothing, gadgets, or entertainment.

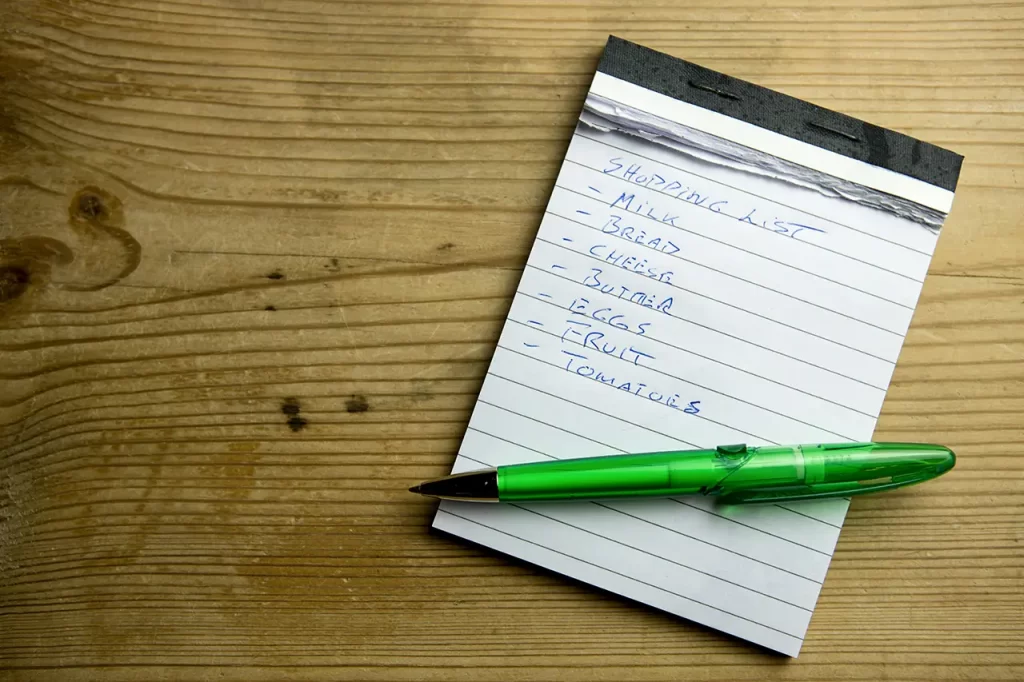

Compile a Shopping List and Prioritise Needs Over Desires

Before setting foot in a store, compile a list of items you genuinely need and adhere to it. Concentrate on fulfilling your needs rather than succumbing to fleeting desires. Exercise discipline in prioritising essential purchases over frivolous wants.

Sleep on It

When confronted with the temptation to make a spontaneous purchase, impose a cooling-off period by sleeping on the decision. Delaying the purchase allows time for rational contemplation and facilitates differentiation between genuine needs and impulsive desires. You may find that the initial urge to buy dissipates after a night’s rest.

Shun Shopping When Emotional

Shopping while experiencing heightened emotions, whether positive or negative, heightens the risk of impulse purchases. If you’re feeling stressed, anxious, or excessively excited, refrain from shopping until you’re in a calmer state of mind. Engage in alternative activities such as exercise, meditation, or spending time with loved ones to manage emotions without resorting to retail therapy.

Unsubscribe from Retail Newsletters and Alerts

Constant inundation with promotional emails and notifications from retailers can tempt you into making impulsive purchases. Take charge of your inbox by unsubscribing from unnecessary newsletters and alerts. Limiting exposure to marketing stimuli reduces the temptation to splurge on unplanned purchases.

Implement the 24-Hour Rule

Adopt the 24-hour rule for significant purchases. Instead of succumbing to impulse buying, commit to waiting a full day before making a buying decision. During this period, thoroughly evaluate whether the purchase aligns with your long-term goals and priorities. If deemed necessary after 24 hours, proceed with the purchase confidently.

Monitor Your Spending Habits

Maintaining a record of your expenses can provide valuable insights into your spending habits and identify patterns of impulsive buying. Utilise budgeting apps or spreadsheets to monitor every purchase, no matter how small. Regularly reviewing your spending enables you to identify areas where you can cut back and reinforce mindful spending habits.

Conclusion

Impulse purchases can derail your financial goals and leave you with regrettable acquisitions. By comprehending the psychological triggers behind impulse buying and implementing practical strategies, you can regain control over your spending habits and make more deliberate purchasing decisions. Remember, it’s not about depriving yourself of joy but rather prioritising what truly matters and aligning your spending with your values and goals. So, the next time you feel the urge to splurge impulsively, pause, reflect, and opt for mindful spending instead.

Armed with these strategies, you’re well-equipped to navigate the temptations of impulse purchases and make informed choices that resonate with your financial well-being. Happy shopping, and may your wallet express gratitude for your newfound restraint!

No Comments